Complete the Type of Business Section. If youre a visitor or expat from the US its easy to confuse the UTR with a tax identification number TIN.

Malaysia Personal Income Tax Guide 2020 Ya 2019

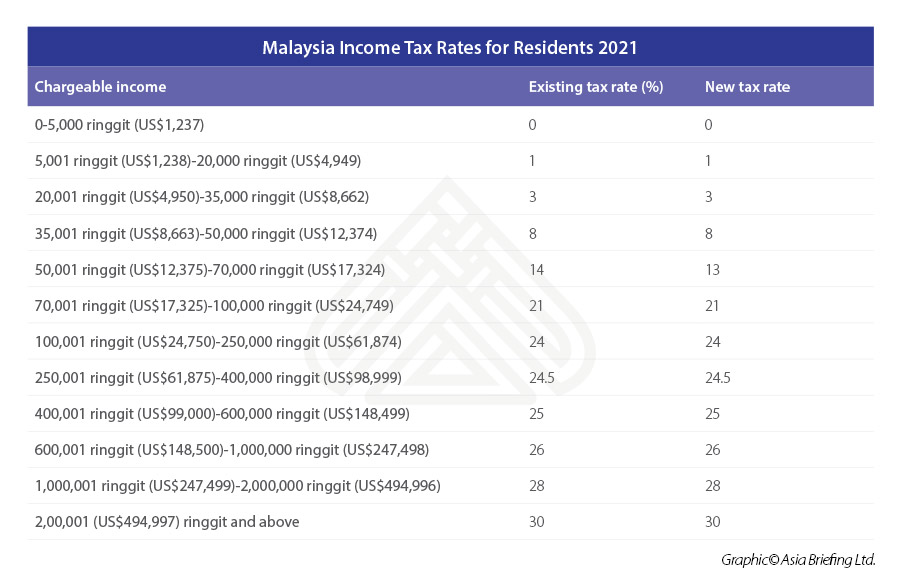

Individual Income Tax Amendments In Malaysia For 2021

2

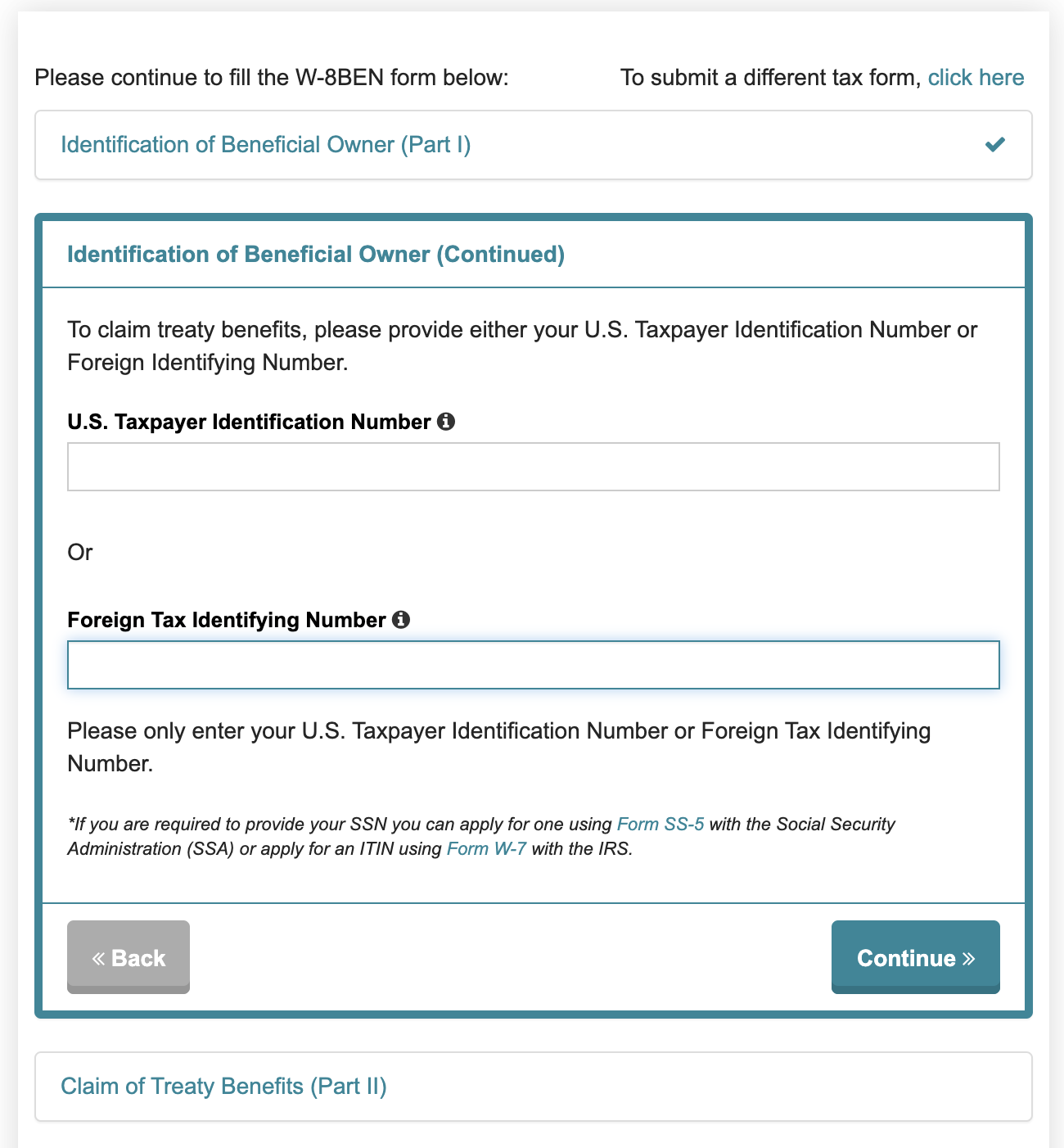

Income tax on the scholarship fellowship or other remittance you can avoid income tax withholding by giving the payor a Form W-9 Request for Taxpayer Identification Number and Certification with an attachment that includes the following information.

Tax identification number malaysia. The EORI number is used for completing customs formalities and is the way that customs authorities identify who is importing or exporting goods. Theres a federal minimum wage in Australia which as of July 2020 is 75380 per week or 1984 per hour but most job sectors are bound by award wages. Many domestically consumed items such as fresh foods water electricity and land public transportation are zero-rated while some supplies such as education and health services are GST exempted.

This tax is included in the final price that clients pay. This is the largest ever state budget worth some 3332 billion ringgit US802 billion as the government aims to boost post-pandemic growth. Foreign Diplomat Number The purchaser must enter the 10-digit number displayed beneath the photo on their tax exemption identification card.

On October 29 2021 Malaysia unveiled a variety of tax measures in its new budget that will impact businesses and individuals in 2022. An EIN is a unique 9-digit number similar to a Social Security Number for an individual. The complete texts of the following tax treaty documents are available in Adobe PDF format.

VAT or Value Added Tax is an indirect tax-supported by consumers when they buy a product or a service. The EIN or Employer Identification Number is also known as a federal Tax Identification Number TIN and is used to identify a business or nonprofit entity. The Bank Identification Number BIN also called Issuer Identification Number IIN is the portion of the credit card number that identifies the card issuing institution tipically a bank that issued the card to the card holderThe rest of the number Primary Account Number or.

The deadline for filing your income tax returns form in Malaysia varies according to what type of form you are filing. Tax identification number UK. 4006-0000-01 Name Address of Seller This information can be obtained from the vendor and is required.

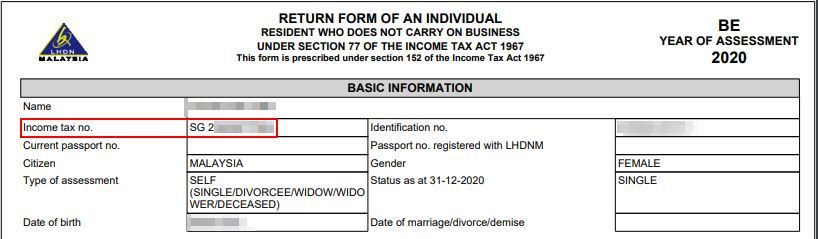

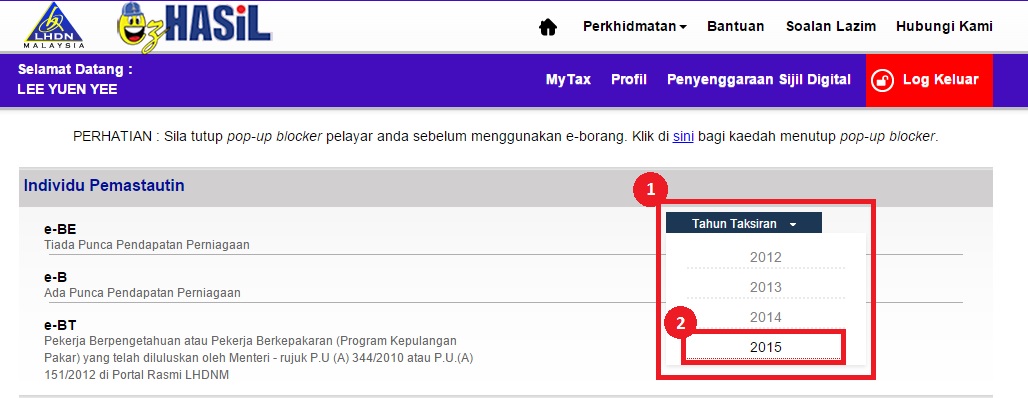

For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021 via e-Filing. BIN Generator for all Banks and any Credit Card Network Generate and look up valid BIN codes from banks worldwide. The Income Tax Number is allocated by the Inland Revenue Board of Malaysia when you register for tax.

Lembaga Hasil Dalam Negeri Malaysia abbreviated LHDNM. Okay now I was in the March 2021 batch of sellers forced onto MP. Your Income Tax Number is a unique reference number that is to be used by you in all dealings with the Inland Revenue Board of Malaysia Malay.

Since 1 January 2021 this includes EU countries. If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat ReaderFor further information on tax treaties refer also to the Treasury Departments Tax Treaty Documents page. It will also send you a notice of its action along with the remaining 500 that was due to you as a tax refund.

Income tax deadline 2021. Legal Name Doing Business As. The standard rate is currently set at 6.

A national identification number national identity number or national insurance number is used by the governments of many countries as a means of tracking their citizens permanent residents and temporary residents for the purposes of work taxation government benefits health care and other governmentally-related functions. TAX IDENTIFICATION NUMBER TIN 1 Income Tax Number ITN The Inland Revenue Board of Malaysia IRBM assigns a unique number to persons registered with the oard. You can file your taxes on ezHASiL on the LHDN website.

Malaysia Information on Tax Identification Numbers Updated 2 December 2020 Section I TIN Description Malaysian Income Tax Number ITN or functional equivalent In Malaysia both individuals and entities who are registered taxpayers with the Inland Revenue Board. Last night when I logged in to print a label for an item that my phone said had just sold I had an alert banner across the top of my home page stating that I must provide my tax id. The TIN is used by the Internal Revenue Service IRS in the US in its tax system and can refer to a persons Social Security Number SSN or.

Cash back is subject to financial performance applicable tax service fee deductions and no claims incurred during the coverage period. Once you do you will be asked to sign the submission by providing your identification number and MyTax password. An EORI number is used to identify businesses that want to import or export physical goods to another country.

For non-Singapore citizens and permanent residents you can find your tax identification number on your tax returns. TOP will deduct 1000 from your tax refund and send it to the correct government agency. The deadline for filing income tax in Malaysia also varies according to what type of form you are filing.

Gone are the days of queuing up in the wee hours of the morning at the tax office to complete your filing. This unique number is known as Nombor ukai Pendapatan or Income Tax Number ITN. How to file your personal income tax online in Malaysia.

This section provides an overview of domestic rules in the jurisdictions listed below governing the issuance structure use and validity of Tax Identification Numbers TIN or their functional equivalents. Supporting Documents If you have business income. Salary working hours and Tax File Number.

You were going to receive a 1500 federal tax refund. Heres an example. But you are delinquent on a student loan and have 1000 outstanding.

How To Pay Income Tax In Malaysia. For Singapore citizens and permanent residents your tax identification number is your IC. Tax Offences And Penalties In Malaysia.

For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2020 for manual filing and 15 May 2020 via e-Filing. Name address and GSTIN Goods and Service Tax Identification Number or UIN Unique Identification Number if registered of the recipient. Or SSN for the purpose of 1099 IRS reporting.

Name and address of the recipient and delivery address of the consignment along with the name of the State and State code in case the recipient is an unregistered person and the value of goods exceeds INR 50000. If you qualify under an exception to the treatys saving clause and the payor intends to withhold US. For US citizens this can be your social security number.

All countries from the European Union and many other countries use this tax system. Unlimited number of breakdown towing up to 50km With over 200 panel workshops all over Malaysia you need not to worry about looking for a workshop near you. The goods and services tax GST is a value-added tax introduced in Malaysia in 2015 which is collected by the Royal Malaysian Customs Department.

The ways in which such a system is implemented vary among.

How To Sign Up As A Medium Writer For Malaysians By Khor Lee Yong Medium

Beginner S Guide Investing Abroad Via Interactive Brokers From Malaysia

Just An Ordinary Girl How To Do E Filing For Income Tax Return In Malaysia

Tax Identification Number To Be Introduced In Jan 2021 Says Deputy Finance Minister Malaysia Malay Mail

2

2

Malaysian Identity Card Wikipedia

How To File Income Tax In Malaysia Using E Filing Mr Stingy