This full version contains the full text of the Model Tax Convention as it read on 21. General consulting income is excluded from salary tax but is subject to tax on income see the Taxes on corporate income section in the Corporate tax summary for more information on CIT although rules exist that may deem certain.

Comparing Tax Rates Across Asean Asean Business News

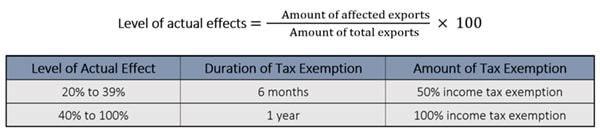

Cambodia Issues Tax Relief Measures For Textile And Garment Enterprises To Mitigate Eba Suspension Tilleke Gibbins

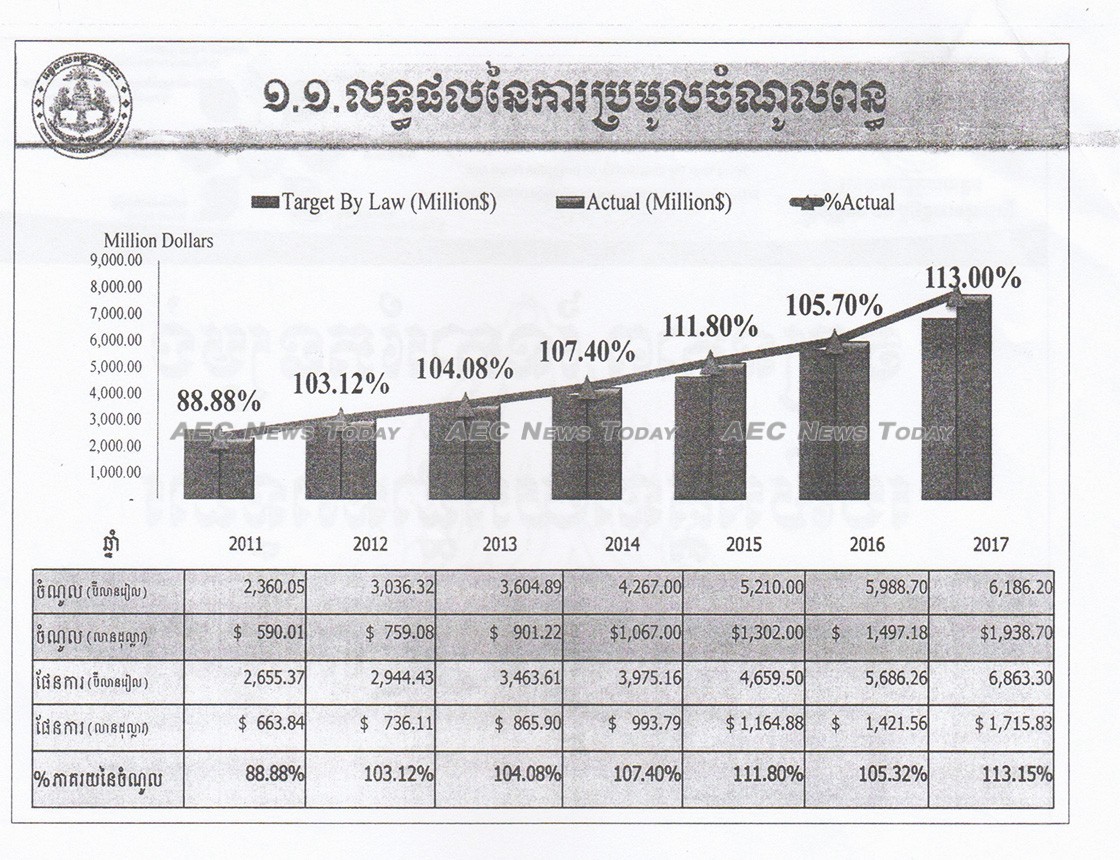

1 Tax System And Tax Regime In Cambodia Kingdom Of Cambodia Ministry Of Economy And Finance General Department Of Taxation Prepared By 1 Mr Tech Sokun Ppt Download

Small businesses to benefit They are part of a resolution adopted by the National Assemblys Standing Committee on Oct.

Income tax in cambodia. Earlier today we released estimates for how the seven tax brackets. Properties with rental payments exceeding PHP12800 US272 per month received by landlords whose gross annual rental income exceed PHP1919500 US40840 are subject to 12 VAT. Data and research on tax including income tax consumption tax dispute resolution tax avoidance BEPS tax havens fiscal federalism tax administration tax treaties and transfer pricing This publication is the tenth edition of the full version of the OECD Model Tax Convention on Income and on Capital.

There is no personal income tax per se in CambodiaInstead a monthly salary tax is imposed on individuals who derive income from employment. 5 A 12 Value Added Tax VAT is imposed on residential property leases that satisfy certain conditions. 19 with a number of solutions to support enterprises and individuals affected by the pandemic according.

An individual income tax or personal income tax is levied on the wages salaries investments or other forms of income an individual or household earns. Income tax is a tax on the income of an individual or an entity. Our suites of tax calculators are built around specific country tax laws and updated annually to provide a dependable tax calculator for your comparison of salaries when looking at new jobs reviewing annual pay rises looking at staff.

The Income Tax Country-by-Country Reporting Rules 2016 and Labuan Business Activity Tax Country-by-Country Reporting Regulations collectively CbC Rules require Malaysian multinational corporation MNC groups with total consolidated group revenues of RM3 billion and above in the financial year preceding the reporting financial year to prepare and submit CbC Reports to IRB no later. The Personal Income Tax Rate in Switzerland stands at 40 percent. In the long-term the Nigeria Personal Income Tax Rate is projected to trend around 2400 percent in 2021 according to our econometric models.

The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Employer Registration Local Earned Income Tax Withholding If you are human leave this field blank. Personal Income Tax Rate in Switzerland averaged 4009 percent from 2004 until 2020 reaching an all time high of 4040 percent in 2005 and a record low of 40 percent in 2008.

This page provides - Switzerland Personal Income Tax Rate - actual values historical data forecast chart statistics economic calendar and news. Free Online Salary and Tax Calculators designed specifically to provide Income Tax and Salary deductions for Individuals families and businesses. You are entitled to receive a written explanation of your rights with regard to the audit appeal enforcement refund and collection of local taxes by contacting your Tax Officer.

Gibraltar Last reviewed 30 June 2021 125 from 1 August 2021 10 up to 31 July 2021. From 875 to 203 depending upon the location of the business establishment. The jobs of government are not just restricted to defense law and order etc but it also has to undertake activities like welfare and development under sectors of health education rural development etc.

Lawmakers have decided to offer businesses affected by Covid-19 a 30-percent reduction in income tax and value-added tax and waive late-payment fees in 2020 and 2021. Income tax is the main source of income for the government to carry out its functions. Ghana Last reviewed 29 July 2021 25.

The VAT burden is generally shouldered by the tenants. Personal Income Tax Rate in Nigeria is expected to reach 2400 percent by the end of 2020 according to Trading Economics global macro models and analysts expectations. Specifically the income tax is structured around seven tax brackets which impose rates from 10 to 396 on each additional dollar that individuals earn.

Imposes a progressive income tax where rates increase with income. Most taxpayers are aware that the federal income tax is designed to tax individuals with higher incomes at higher rates. The government also has to pay for.

Utility and energy providers and corps abusing a dominant position pay a. Corporate income taxsolidarity surcharge.

Exchange Rate Cambotax

Tax In Cambodia Tax In Cambodia

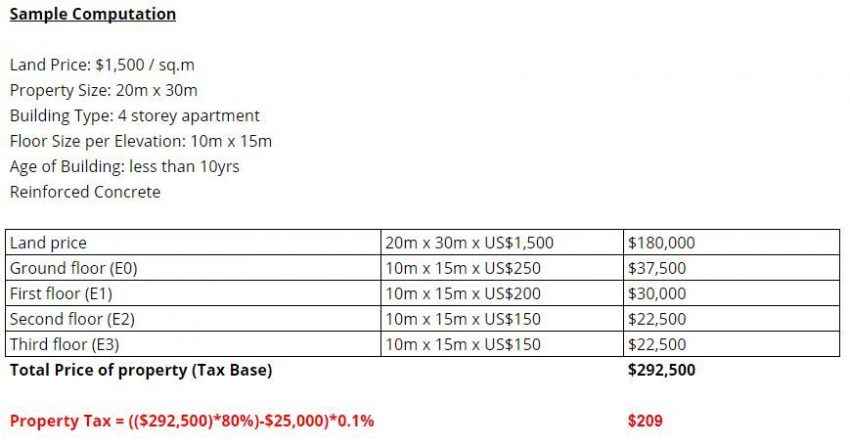

Ultimate Guide On Cambodia Property Tax Ips Cambodia Real Estate

How To Declare Tax For Small Enterprises News Eurocham Cambodia

Cambodia Annual And Monthly Tax Filing 2020 B2b Cambodia

Tax Consultants In Cambodia By Nikhil Kumar Issuu

Cambodia Tax Chief Comply Or Be Fined Possibly Shunned

How To Calculate Salary Tax In Cambodia Inspiring Video