A common method customers use to pay is with a check but you run the risk of receiving an NSF check. Dave recommends telling every dollar where it should gobefore the month beginsusing a zero-based budgetThis means that your income minus your expenses equals zero.

Malaysia Personal Income Tax Guide 2020 Ya 2019

How Do I Register For Tax How Do I Obtain An Income Tax Number Tax Lawyerment Knowledge Base

U S States Use Big Data To Catch Big Thieves Ieee Technology And Society

Tax Policy Center T21-0088 Baseline Distribution of Income and Federal Taxes All Tax Units by Expanded Cash Income Percentile.

Cara check income tax. As a result this income will be considered a short-term capital gain. Call your bank directly and cancel any recurring payments for speed and ease you can alternatively call the 159 hotline. Our passion is helping small businesses and nonprofits grow and succeed.

An accounting method that considers how current fiscal policies affect future generations. Here are five things you do after accepting an NSF check. Below is a need-to-know checklist of what you should do.

Xcel Energy offers 500 Home Wiring Rebate for L2 Residential Charger. At present the short-term capital gains tax rate ranges from 10 to 37 depending on the income of the household. This makes it easy to check your account to see the status and transactions transfer money and conduct other banking businessOne of the things you can do in your online banking account is get your bank statement.

If your income is above the state median you still might qualify. Electric Vehicles Solar and Energy Storage. Wendroff Associates is a full-service Certified Public Accounting firm serving Virginia DC and Maryland.

Carbon pricing is an instrument that captures the external costs of greenhouse gas GHG emissionsthe costs of emissions that the public pays for such as damage to crops health care costs from heat waves and droughts and loss of property from flooding and sea level riseand ties them to their sources through a price usually in the form of a price on the carbon dioxide CO 2 emitted. For purposes of the PTC household income is the modified adjusted gross income modified AGI of you and your spouse if filing a joint return see Line 2a later plus the modified AGI of each individual whom you claim as a dependent and who is required to file an income tax return because his or her income meets the income tax return filing threshold see Line 2b later. If youve already responded to a scam end all further communication immediately.

Check this off your list. Dem senator says hell only support Bidens child tax credits program if it includes a work requirement and 60000 family income cap -. Report the scam to the police through Action Fraud on 0300 123 2040 or report a scam anonymously on its website.

The first means test form Chapter 7 Statement of Your Current Monthly Income Form 122A-1 determines whether your income is below your states median income. SEMAKAN NO CUKAI PENDAPATANSYARIKAT MALAYSIACara Check Income Tax Number Online Sekiranya anda pembayar cukai sama ada individu atau syarikat yang telah berdaftar semestinya anda mempunyai nombor cukai pendapatan Malaysia. For instance a married couple with two children only qualify if their income is below about 53000 according to the state of.

Your crypto assets will be considered as taxable ordinary income if you retain them for a year or less that is 365 days or fewer. We provide business and individual tax preparation CFO Consulting Quickbooks Online training bookkeeping and accounting services. In the examples below well only look at federal income tax and use the top tax bracket 29 but keep in mind you have to pay provincial taxes on this income as well.

For instance if you planned to file your bankruptcy paperwork on November 20 2020 youd include all income received starting May 1 2020 and continuing through October 31 2020. Alternatively you can refer to our income tax content for other tax-related information such as the new. For the means test purposes your current monthly income CMI is the average monthly income you receive from all sources during the full six-month period preceding your filing date.

To TransUnion CIBIL Limited Formerly known as Credit Information Bureau India Limited One Indiabulls building Unit No 1901 1905 19th Floor Tower 2A-2B Jupiter Mill compound Senapati Bapat Marg Lower Parel Mumbai 400 013 Sub. A budget is a plan for how youre going to spend your money. The tax rate also varies based on your overall taxable income and there are limits to how much you may deduct in capital losses if your crypto asset loses value.

You might think that moving to a state with no income tax would greatly simplify. It puts you in charge and in control of every dollar that you earn or spend. Did the military.

Local and Utility Incentives. When you own an asset for more than a year and sell it for a profit. Most banks today offer online banking for both deposit and credit card accounts.

As a single person you would pay taxes on that extra 50000 in income at the 24 federal tax rate. Fort Collins offers a 250kW incentive up to 1000 filed on behalf of the customer. If it is you qualify for a Chapter 7 bankruptcy and dont need to fill out the other two forms.

Said Cara Griffith editor-in-chief of state tax publications for Tax. Xcel Energy offers income qualified customers 5500 rebate for new and 3000 rebate for used eligible electric vehicles in lieu of state tax credit. Most states also deduct an income tax the average being 60 percent which would bring the top rate to 574 percent Taxpayers in California would take the biggest hit at 647 percent and New.

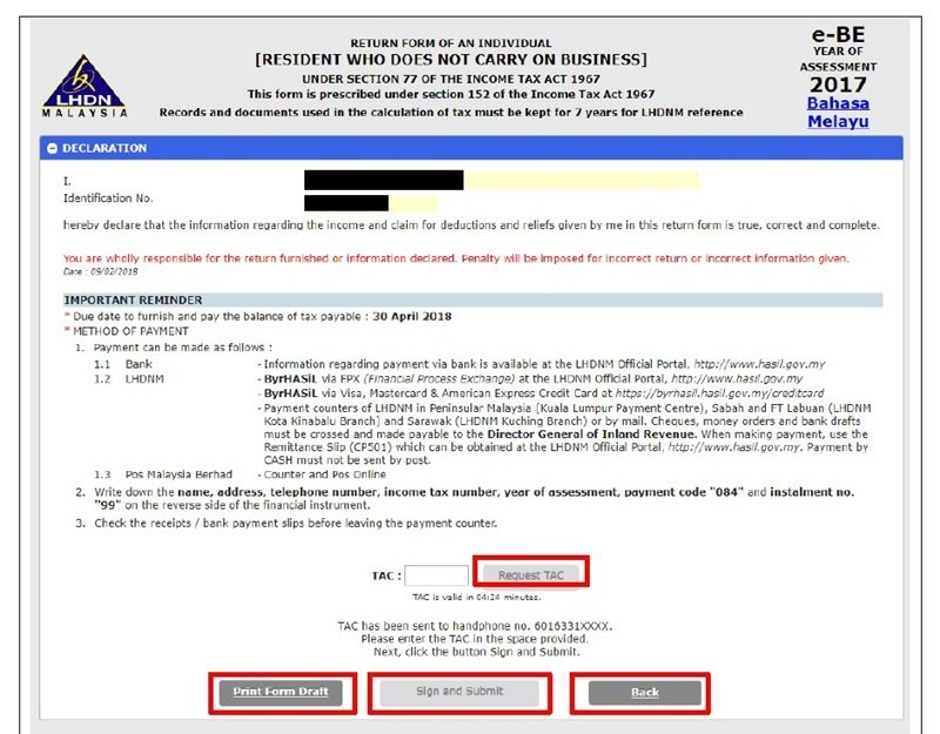

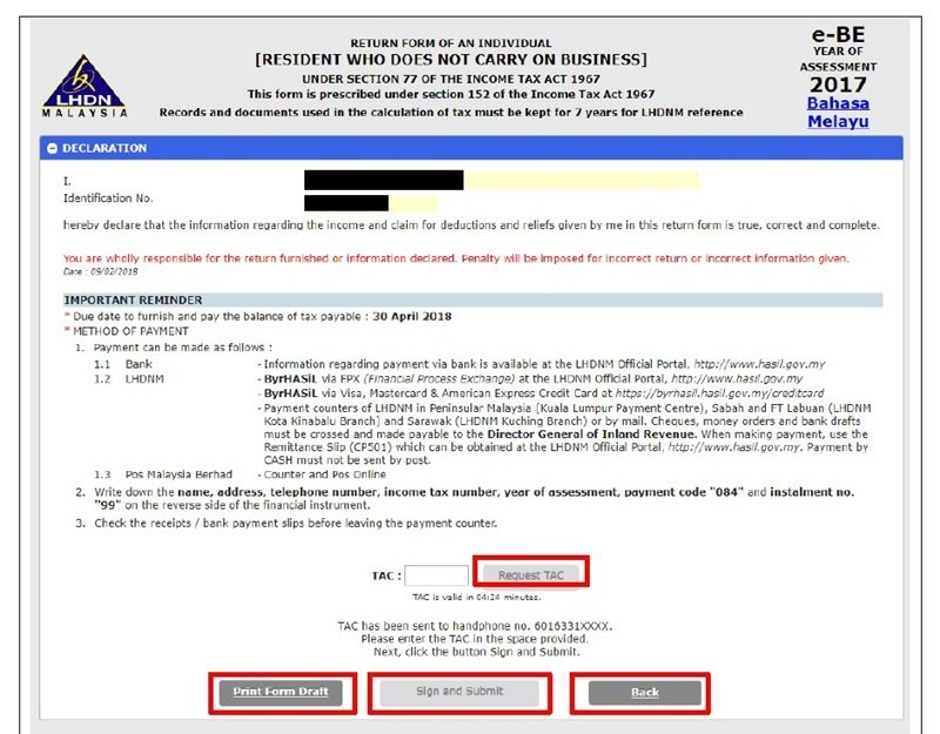

The EITC is a tax credit geared to low- to moderate-income earners. Services and Resources available to assist you. If you need further step-by-step guidance on how to fill in your income tax form do also check out our income tax guide for 2021 YA2020 here.

Health Insurance and Health Assistance Programs. How to Get a Bank Statement Online. Dear Sirs In connection with submission of the application for my credit information offered by CIBIL.

CIBIL TERMS AND CONDITIONS. For example say you flip a house and earn a 50000 profit on top of your 85000 salary.

Itr V How To Send Itr V To Income Tax Department Cpc Bangalore

Avoid Lhdn S 300 Tax Penalty Here S How To Declare Income Tax

Singapore Personal Income Tax Guide How To File And Pay Your Personal Income Tax Ya 2021

Here Is A Simple Guide On How To Submit Your Tax Return Stress Free

Oecd Org

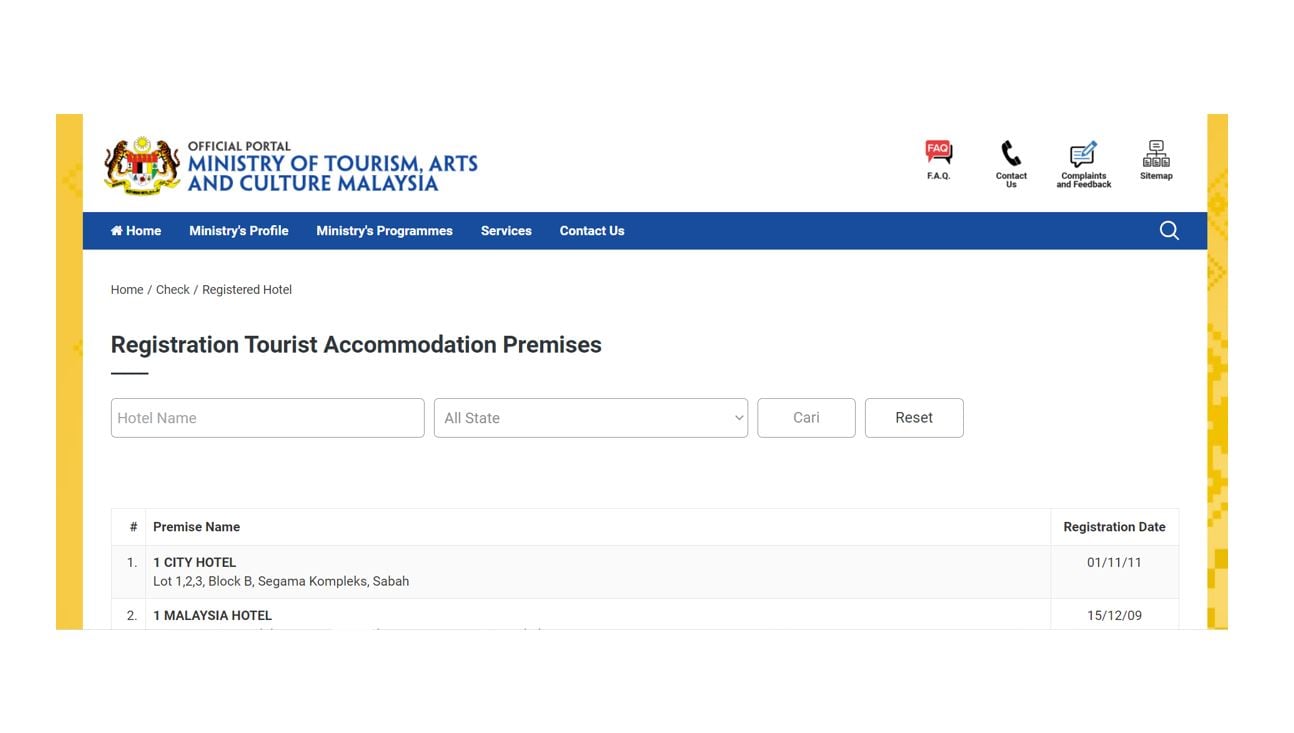

How To Check If Your Hotel Stay Is Eligible For The Tourism Tax Relief

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Just An Ordinary Girl How To Do E Filing For Income Tax Return In Malaysia