There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so make sure you. Credit Card Reviews Reviews for the top credit cards in.

4 Benefits Of An Investment Holding Company Ihc In Malaysia Propertyguru Malaysia

![]()

Set Up A Investment Holding Company For Fundraising In Sg

Inland Revenue Board Of Malaysia Investment Holding Company Pdf Free Download

If the company directly holding at least 10 of the capital is an investment institution the 15 rate instead of the 0 rate applies.

Investment holding company tax rate malaysia. This means that you would be able to sell the property within the six-year period and be exempt from paying capital gains tax just as you would if you sold the house considered your main residence. The system is thus based on the taxpayers ability to pay. The lower rate applies if it concerns a payment to the beneficial owner of interest on a loan granted from a bank or any other financial institutions from Albania including investment banks saving banks and insurance companies.

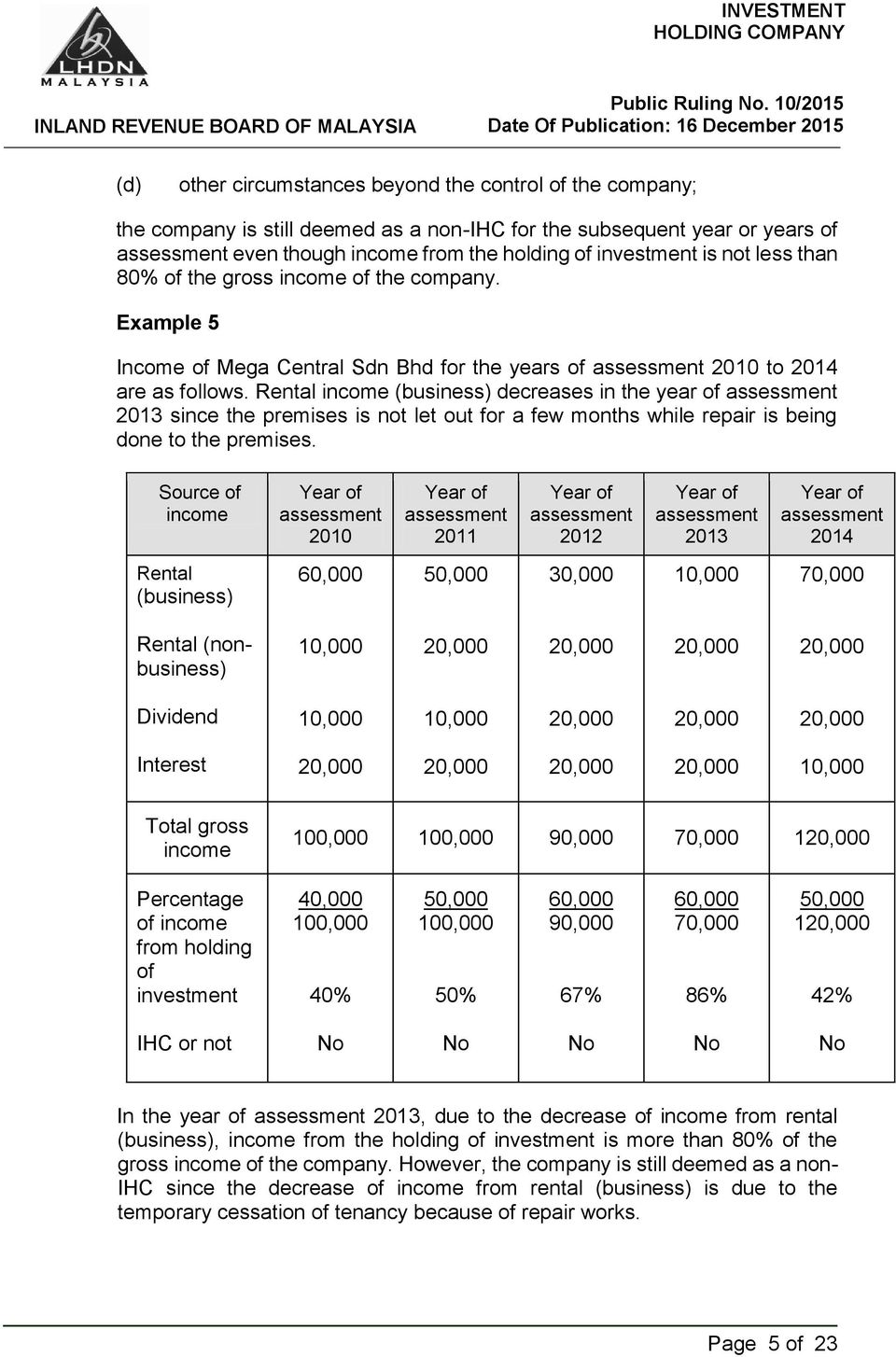

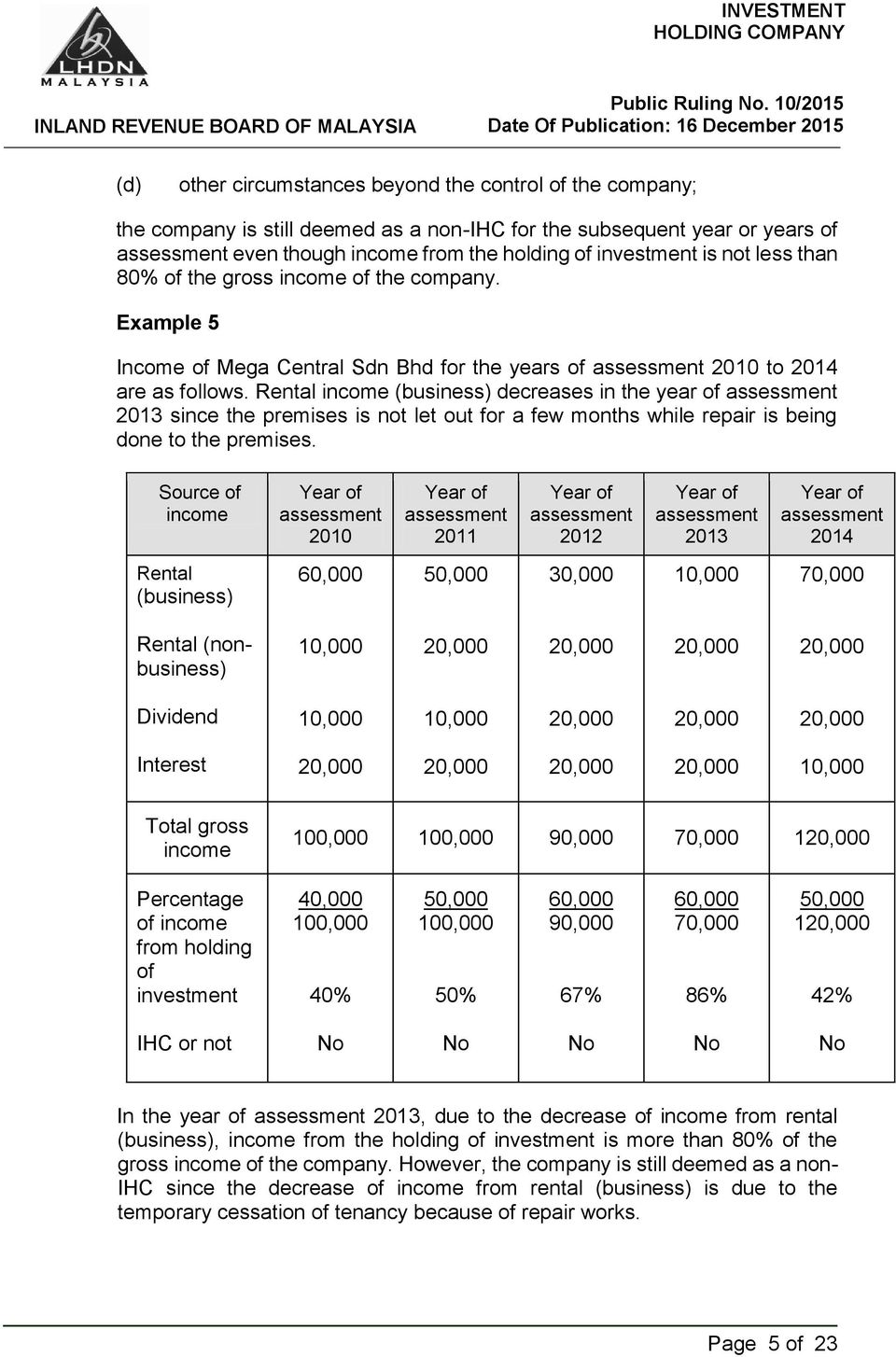

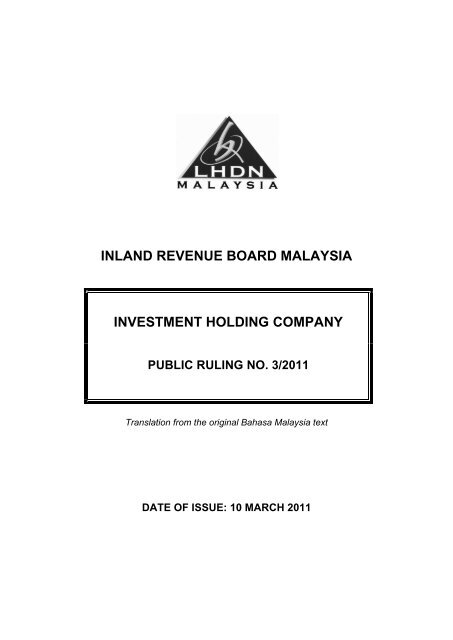

Prevent foreign holders of 10 or more of a domestic corporations shares by value from avoiding withholding tax by holding low-vote stock. However under the single-tier system discussed earlier the interest cost incurred by an investment holding company would be lost because the investment income ie. This means that low-income earners are imposed with a lower tax rate compared to those with a higher income.

Increase the individual tax rate. The 26th United Nations Climate Change Conference of the Parties COP26 brings together countries to address global climate change issues. As countries and companies focus on how they can enact positive environmental change by reducing global emissions by half by 2030 we provide commentary on the outcomes and common themes from COP26 and the potential impact on the.

A natural person a local resident must be the secretary of the Singapore offshore companyIt may not be in the same time shareholder of the company or manager. A real estate investment trust REIT is a company that owns and in most cases operates income-producing real estateREITs own many types of commercial real estate ranging from office and apartment buildings to warehouses hospitals shopping centers hotels and commercial forestsSome REITs engage in financing real estate. With proper tax planning it is easier to reap the tax benefits that Malaysia has to offer if you were to set up an Sdn Bhd company.

Increase the top marginal individual income tax rate from 37 to 396 beginning in 2022 instead of 2026. Unlisted Investment Holding Company IHC taxed under Section 60F is deemed to have no business income and it is not eligible for above special tax treatment and taxed at 24. Answer varies depending on the current Fixed Deposit FD rate.

A holding company that has financial strength can often obtain loans for a lower interest rate than its operating companies could themselves particularly where the business in need of capital is a startup or other venture considered a credit risk. Solarvest Becomes The First Pure-Play Solar Company in The Main Market of Bursa Malaysia October 13 2021. In general when German resident taxpayers directly or indirectly own more than 50 percent of the shares in a foreign corporate subsidiary vote or value that i is subject to a low rate of taxation effective tax rate less than 25 percent and ii earns income from passive activities not included in Section 8 1 of the German Foreign Transactions Tax Act any qualifying passive income.

Individual and Partnership Tax Proposals. CompanyLLP have no business income including those temporary closed but with other income which is not taxed under paragraph 4a ITA is not eligible for above special tax treatment and taxed at 24. There is no authorized capital requested at incorporation of an offshore company in Singapore but a symbolic share capital of at least 1 dollar must be deposited.

The equity-linked saving scheme is the diversified mutual fund scheme which has two different features- first the investment amount in ELSS scheme is eligible for tax exemption up to the maximum limit of Rs15 Lakh under section 80C of Income Tax Act and secondly the investment made in ELSS has a lock-in period of 3 years. How To Guides Get the most out of Malaysias banks and finance companies when you save invest insure buy and borrow. The capital gains tax property 6-year rule allows you to use your property investment as if it was your principal place of residence for a period of up to six years whilst you rent it out.

Most countries laws on REITs entitle a real estate company to. All your banking questions about credit cards debit cards personal loans home loans car loans savings and investment are answered in our comprehensive articles. It has to be relative to that.

An investment holding company may deduct its interest expense against its taxable investment income pursuant to section 331. As mentioned above Singapore is one of the largest exporters in the world and its main trading partners are China Malaysia Indonesia Hong Kong and AustraliaAs a percentage 14 of Singapore s exports go to China Malaysia and Indonesia import 12 each from companies in Singapore as for Hong Kong and Australia represent 75 respectively 6 of the territorys total exports. But do note that for an active trader who trades several times a month and often make profit in the short term weeks or months it is considered trading and not investment.

Green Investment Tax Allowance. If FD risk free rate is 8 a year then dividend yield of no lesser than 9 per year can be considered good. Sdn Bhd companies in Malaysia have a much better market perception as it is viewed as a stable and transparent type of business entity thanks to the stringent reporting requirements that it needs to abide by.

Source-country tax on dividends will be generally limited to 15 subject to an exemption for dividends paid to certain pension funds or government investment funds beneficially holding less than 10 of the voting power in the company paying the dividend and a 5 limit that will apply to dividends paid to companies with voting power of 10 or greater in the dividend paying company. Dividend income would be tax-exempt. The holding company can obtain the loan and distribute the funds to the subsidiary.

Each payment type has a different tax rate according to Section 107A and Section 109 of the Income Tax Act 1967. Competent personnel are defined as holding a certificate of competency as a service provider in the related field of green technology. As an impediment the Singapore legislation is not allowing a foreign.

Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system. To make Malaysia a destination for high value service activities in addition to the tax incentives offered to companies relocating their operations to Malaysia individual income tax at a flat rate of 15 be given to non-citizens holding key positions C-Suite positions for a period of 5. Withholding tax is applicable only if your company is paying a non-resident individual or company known as the payee for their services where a certain percentage of the payment is deducted and paid as their income taxes to the LHDN.

Individuals paid capital gains tax at their highest marginal rate of income tax 0 10 20 or 40 in the tax year 20078 but from 6 April 1998 were able to claim a taper relief which reduced the amount of a gain that is subject to capital gains tax thus reducing the effective rate of tax depending on whether the asset is a business asset or a non-business asset and the length of the. The Rate of Incentive. Say if FD rate is 270 then stocks dividend of 3 or above is good.

Malaysia government also dont tax on capital gain or dividend. Find the latest business news on Wall Street jobs and the economy the housing market personal finance and money investments and much more on ABC News.

Set Up A Investment Holding Company For Fundraising In Sg

What Is Investment Holding Company Ihc Anc Group

Setting Up An Investment Holding Company Ihc In Malaysia What Property Investors Need To Know Iproperty Com My

Individual Income Tax Amendments In Malaysia For 2021

Comparison Singapore Vs Hong Kong Company Incorporation Rikvin

Investment Holding Company What Is It Life Of A Working Adult

Inland Revenue Board Malaysia Investment Holding Company

Characteristics Of Holding Companies In Singapore